Why peace hits harder than any flex

There is a moment in your money journey that does not get enough attention.

It is the moment when you realize the quiet things you do with your money feel better than anything loud you could buy.

Not because you stopped wanting nice things.

But because feeling safe started feeling nicer.

Most people chase the high of a purchase.

The rush.

The quick lift.

The temporary thrill.

But the truth is simple.

The things that actually change your life do not scream.

They whisper.

Quiet money wins look like this:

• Checking your balance without heartache

• Watching your savings grow a little higher every week

• Paying for something in full instead of “floating it”

• Walking past something you want and knowing you are still in control

• Saying yes to rest because the bill is already paid

None of that shows up on social media.

But your body can feel it.

It feels like breathing again.

The truth no one tells you

Flashy purchases impress people for five seconds.

Peace impresses you for years.

The pair of shoes you bought?

Cute.

But the night you do not lose sleep over money?

That is a different kind of luxury.

And the crazy part is that peace comes from tiny changes.

Small choices repeated quietly.

Little habits that look boring but hit your life like a miracle.

Think of money like a garden.

Flashy purchases are like planting a firework in the soil.

Big spark.

Nothing left afterward.

Quiet money wins are seeds.

They make your life grow in ways you do not see at first.

Then one day you look around and realize your life feels softer.

Safer.

Wider.

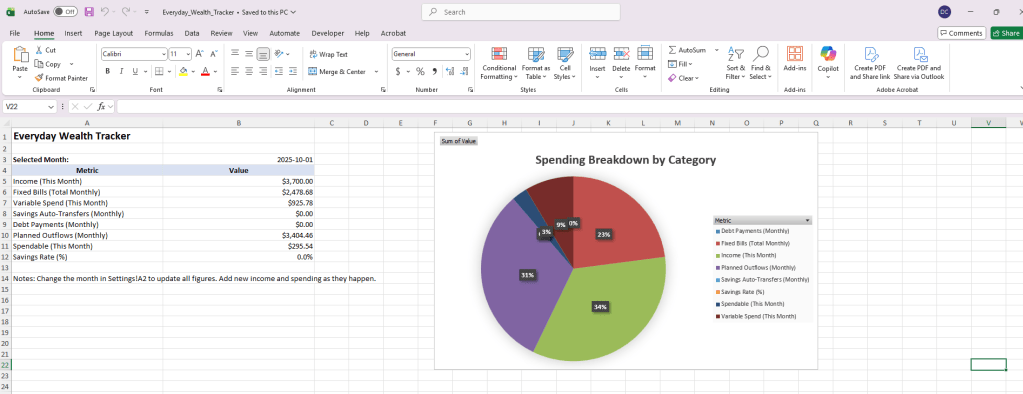

How to build your own quiet money wins

Here is the part people skip.

You cannot create quiet money wins if you have no way to track them.

You need a simple system.

Something that shows you the small progress you forgot you made.

Something that reflects your growth back to you.

Something that makes peace feel possible.

Because once you see your progress, you protect it.

And once you protect it, your life starts to shift.

The real flex

The real flex is logging into your accounts and feeling calm.

The real flex is buying what you want without guilt.

The real flex is knowing your money listens to you, not the other way around.

Quiet wins are not boring.

They are freedom.

And the best part is that anyone can start building them today.

One small habit at a time.

One choice at a time.

One quiet win at a time.

Ready to create your own quiet wins?

If you want a money system that feels simple and calming instead of stressful, the Everyday Wealth Tracker helps you build those quiet wins with ease. It gives you a clear place to follow your money, plan your choices, and see your progress grow. No overwhelm. No confusion. Just a tool that helps you feel safe and in control.

👉 Get the Everyday Wealth Tracker here and start building real peace